Why is my payment not processing? Payment processing failures can result from a myriad of factors, ranging from technical glitches and insufficient funds to issues with the payment gateway or incorrect payment details. This article delves into the complexities behind unsuccessful transactions, providing a comprehensive overview of historical trends in payment technologies, current challenges in the digital commerce landscape, and future developments poised to shape the industry.

Table of Contents

Through detailed exploration of key concepts, real-world examples, and analysis of different perspectives, readers will gain an in-depth understanding of the intricacies involved in payment processing. Furthermore, the article will offer predictive insights and discuss broader implications for businesses and consumers alike, ultimately providing a robust framework for navigating and resolving payment processing issues.

Why is My Payment Not Processing?

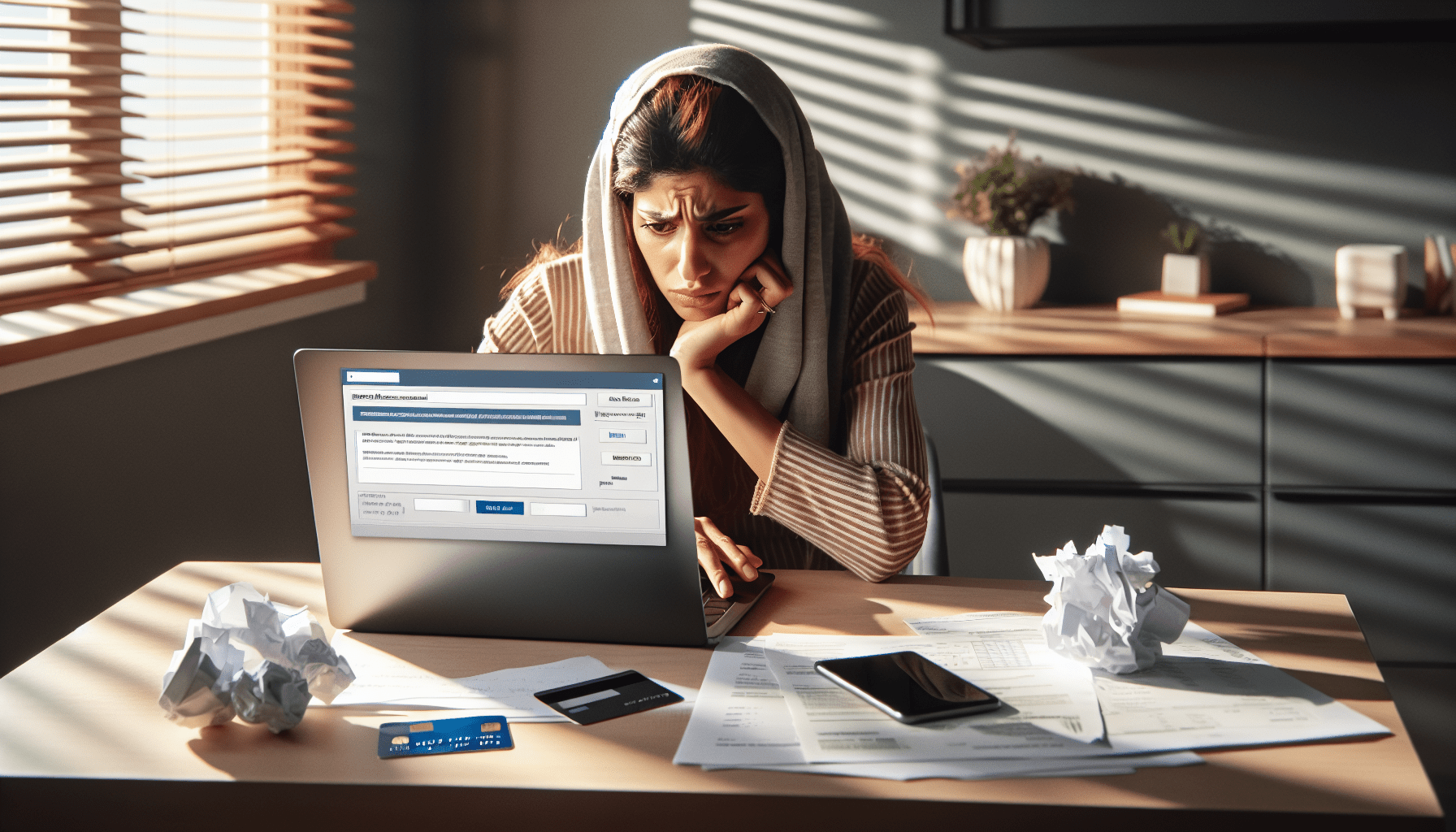

Have you ever attempted to make an online payment only to be met with a frustrating message indicating processing errors? In the digital age, where the convenience of online transactions is at our fingertips, understanding the common issues behind payment processing failures is crucial.

Overview

When payments do not process as intended, the repercussions can range from minor inconveniences to significant financial impacts. This article aims to shed light on why these issues occur, helping individuals and businesses better navigate the complexities of online payment systems.

Thesis Statement

Understanding why payment processing failures occur is essential for individuals and businesses to mitigate financial risks and enhance transactional efficiency.

Why is my payment not processing?

Historical Context

Historically, the evolution of payment systems has been marked by significant advancements. From bartering systems and physical currency to checks and electronic payments, each phase brought its own challenges and solutions. Today, online payments are ubiquitous, but they come with their own set of complexities often leading to processing errors.

Evolution of Payment Systems

| Age | Primary Payment Method |

|---|---|

| Ancient | Barter System |

| Medieval | Coins and Precious Metals |

| Modern | Banknotes and Checks |

| Digital | Credit Cards, Mobile Payments |

In the digital era, the reliance on technology means that system errors are inevitable, making it crucial to understand and address these issues promptly.

Current Trends

As online commerce expands, so do the challenges associated with payment processing. Digital wallets, cryptocurrency, and contactless payments are growing in popularity, each introducing new variables that can affect transaction success rates.

Trends Impacting Payment Processing

- Increased Security Measures: Enhanced security protocols, such as two-factor authentication and EMV chips, can sometimes cause delays or failures in payment processing.

- Rise of Alternative Payment Methods: Platforms like PayPal, and cryptocurrencies create additional layers and complexities in transaction routing.

- Globalization: Cross-border transactions introduce more variables such as currency conversion failures and international banking regulations.

Key Concepts and Definitions

Payment Gateway

A payment gateway is the middleman between the merchant’s website and the financial institutions, enabling online transactions. If issues arise at this stage, payments cannot be processed successfully.

Authorization and Authentication

Authorization pertains to the approval from the financial institution that the shopper has sufficient funds, while authentication verifies the cardholder’s identity.

Declined Transactions

A declined transaction occurs when the issuing bank or the payment processor does not approve a transaction. Common reasons include insufficient funds or incorrect card details.

Detailed Exploration

Common Reasons for Payment Processing Failures

- Insufficient Funds: The most straightforward cause for payment failure is when a user’s account lacks the requisite balance.

- Incorrect Details: Errors in entering card information, such as the CVV code or expiry date, can lead to transaction failures.

- Expired Card: Attempting to use an expired card will result in processing errors.

- Network Issues: Connectivity problems between the user, payment gateway, and financial institutions can disrupt payment processing.

- Security Flags: Unusual spending patterns or transactions from suspicious locations can trigger security mechanisms, causing a payment to be declined.

Example 1: The Case of Shopping Cart Abandonment

A major e-commerce platform noticed that a significant percentage of users abandoned their shopping carts at the payment stage. Upon investigation, it was discovered that:

- Multiple Payment Attempts: Users attempting to pay multiple times due to initial failures led to locked transactions.

- Payment Gateway Downtime: Periodic technical issues with the payment gateway were identified, causing delays and declines.

These findings helped the platform optimize its payment process, resulting in a 15% reduction in cart abandonment rates.

Example 2: International Transactions Failures

A company dealing in international sales noted frequent payment declines from specific regions. After a thorough analysis, the causes identified were:

- Currency Conversion Issues: Some banks were not equipped to handle the currency conversions required for the transactions.

- International Fraud Prevention: Heightened fraud prevention measures led to automatic declines of transactions originating from specific high-risk regions.

By addressing these issues through better currency management and enhanced fraud detection systems, the company improved its successful transaction rate by 25%.

Comparison of Different Perspectives

Merchant vs. Consumer Perspective

| Aspect | Merchant’s View | Consumer’s View |

|---|---|---|

| Transaction Security | Emphasis on robust security to avoid chargebacks | Frustration over declined payments |

| Payment Options | Offering diverse payment methods to attract customers | Preference for convenience and speed |

| Processing Fees | Concern over higher fees affecting profit margins | Unawareness or indifference to underlying fees |

Payment Processor vs. Issuing Bank Perspective

| Aspect | Payment Processor’s View | Issuing Bank’s View |

|---|---|---|

| Fraud Detection | Balancing fast processing and fraud mitigation | Prioritizing security to prevent losses |

| Transaction Approval | Focus on approval rates and customer satisfaction | Emphasis on risk assessment and regulatory compliance |

Impact Assessment

Balancing Security and Convenience

While increased security measures are essential, they often result in more frequent declines for genuine transactions. Finding the right balance is key to ensuring customer satisfaction while minimizing fraud.

Cross-Border Commerce

Global markets offer vast opportunities, but they also come with challenges related to differing banking regulations and currency issues. Addressing these can open up new revenue streams for businesses.

Future Directions and Implications

Predictions

- AI and Machine Learning: Future payment systems will increasingly leverage AI for fraud detection and dynamic transaction routing.

- Blockchain Technology: Adoption of blockchain in payments may streamline transactions and reduce fraud incidents.

Implications

- For Businesses: Understanding and addressing the issues leading to payment failures can significantly enhance the customer experience and reduce lost revenue.

- For Consumers: Greater awareness and understanding of the reasons behind payment failures can lead to smoother shopping experiences and better financial management.

Conclusion

Recap

This article has delved into the myriad reasons why payment processing can fail, from insufficient funds and network issues to security concerns and currency conversion problems. By analyzing historical contexts, current trends, and case studies, it offers a comprehensive understanding of the complexities involved.

Final Thought

Next time you experience a payment processing error, consider the multiple factors at play, from detailed security protocols to international banking regulations. These complexities highlight the ongoing need for advancements in payment technology and better consumer understanding.

Engagement

Readers are encouraged to share their experiences with payment processing issues, contribute additional solutions, or explore more resources on reliable platforms to mitigate payment failures.

Credible Sources

- International Journal of Electronic Commerce – Various articles on electronic commerce and payment systems.

- Journal of Payment Strategies & Systems – Articles on the latest trends and strategies in payment systems.

- Visa’s Guide to Payment Processing – Practical advice from a leading payment network provider.

- Mastercard SecureCode – Details on security measures and common issues related to Mastercard payments.

By providing a structured and detailed exploration, this article aims to arm readers with the knowledge needed to tackle payment processing issues effectively.

Upgrade Your Skincare with The Fame: Atomy’s New and Improved System